Fixed Income and Interest Rates

Much of our strategy in terms of risk management has increasingly been associated with our viewpoints on interest rates and fixed income. Rather than discuss particular trades, I thought that it would be most helpful to provide some commentary in terms of our viewpoints in this area.

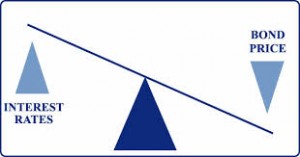

Many investors own bonds as part of their overall portfolio. Bonds are often thought of as the safety portion or “anchor” to an investment portfolio. However, bonds overall are in a precarious situation as rates have remained quite low. Bonds and interest rates have an inverse relationship. Now that our Federal Reserve has increasingly been talking about when to raise rates, this issue is becoming much more prominent.

Low interest rates has created an asymmetrical risk situation, making bonds (overall) a particularly bad bet at the moment. That is because interest rates have a lot of room to increase over time, whereas there is not much room for rates to decrease. For every one percent move up in interest rates treasuries can lose as much as -8.5% (for the ten year treasury bond) and -17% or more (for the 30 year bond).

Because bonds are an important piece of an overall asset allocation, we have identified some strategies that can help in reducing the interest rate risk associated with fixed income.

-

Buy Short Term Bonds: Look to minimize duration in a bond portfolio in order to limit interest rate risk. Duration measures sensitivity to interest rate changes. It is defined based on the number of years it takes for the lender to recoup their investment. Generally investors should keep their duration relatively low in preparation for rising interest rates. If I am invested in a short term bond such as a two year US government note, it can still lose value if short-term rates go up. However, the downside is relatively limited. Once the two year period is up, I can reinvest my principle at the prevailing (potentially) higher interest rates.

-

Buy Floating Rate Bonds: These are bonds that “float” or adjust their interest payments based on changes in interest rates. There are some risks with these. Many of these bonds are subject to default risk as much of the sector is comprised of below investment grade bonds. During the financial crisis, for example, the Barclays Aggregate Bond market index was up just over 5% during the financial crisis in 2008. Floating rate loans on the other hand were negative. Also, when rates are rising the sector gets exposed to the risk of adverse selection. This is because borrowers will tend to want to pay off their floating rate debt in exchange for a fixed loan, in order to manage the risk of increasing loan payments. This leaves more low quality bonds to comprise the category. Despite these risks, floating rate bonds provide a big tactical advantage when rates are rising. In contrast to most bonds, these become increasingly valuable as rates go up.

-

Buy International Bonds:. There is a good possibility that the US will face rising interest rates in the near future, however, many economies have not experienced the economic strength of the US in recent years. Whereas, our country is in the process of exiting “quantitative easing” or stimulus, areas such as Europe and Japan are still trying to juice their economies and do not seem to intend to raise interest rates anytime in the near future. International bonds may provide a nice hedge against potentially rising rates here at home.

-

Buy Unconstrained Bonds: Another option is to look for unconstrained bond managers and focus on those that are able to demonstrate a plan for potentially rising rates. Many of them will buy bonds that they think are undervalued and then short or bet against areas of the bond market that they are bearish on. Unconstrained bond managers (as the name implies) indicates that the managers can invest wherever they like in response to bond market risks and opportunity.

-

Underweight Bonds: Many investors have a certain amount of wiggle room in terms of how much they are willing to invest in bonds within a certain asset allocation. It makes sense for many investors to stay on the low end of their bond allocation if rates begin to rise. Investors can look to increase their exposure to other assets that are lesser correlated to stocks in lieu of bonds. Alternative categories such as Managed Futures or Merger Arbitrage have little correlation with the stock market.

-

Underweight Utilities and Real Estate: Many investors falsely believe that rising interest rates mean that the stock market will crash or correct. The argument that I often hear is that rising rates is the reverse of stimulus and can only mean trouble for the stock market. This is not necessarily accurate. If you look at the three periods in recent history when interest rates were rising (1994-95, 1999-00, & 2004-06), the Federal Funds rate was rising yet the stock market produced positive performance. That being said, there are sectors of the market that I believe investors should steer away from in a rising interest rate environment. I would argue that utilities and real estate are particularly vulnerable to rising rates. Their valuations have been bid up to historically high levels due to the hunt for yield in a low interest rate world. Vanguard’s Real Estate ETF (VNQ) sports a PE ratio of over 30. If you look at these two sectors they have become fairly correlated to long-term bonds which get whacked in a rising rate environment. Last year the ETF TLT (iShares 20+ year Bonds) was up 27.3% while VNQ (Vanguard Real Estate ETF) was up 30.6% and VPU (Vanguard Utilities ETF) was up 26.99%. Within the stock market I would argue that it makes sense for investors to look to invest more so in areas that are less interest rate sensitive such as Technology and Healthcare.